For anyone who desires to have long-term financial stability, financial planning is the way to achieve it. And for that, it is important to analyze goals, evaluate and review one’s risk appetite, identify suitable class of investments.

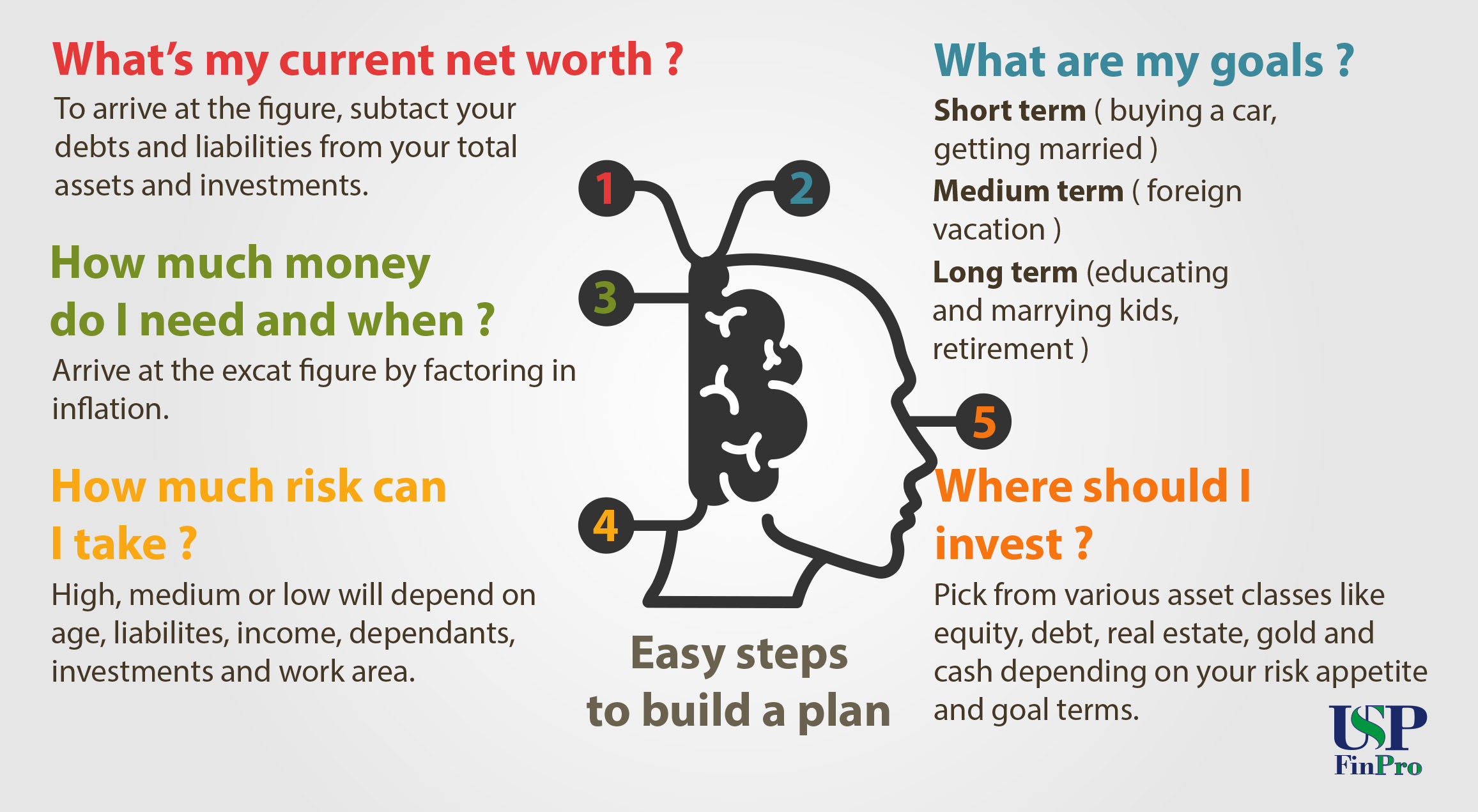

Basically Financial Planning is the answers to the below questions:

- What are my Goals?

- What’s my current Net worth?

- How much risk can I take?

- Where should I invest?

As you see it’s obvious from the questions that it’s a very personal and customized process and the solutions or answers will decide the investment pattern that’s very specific and limited to that particular family ONLY.

Envision the perfect way to achieve your unique lifestyle. Financial planning is different for everyone. Our team works with you to make your dreams a reality

Financial Services and Planning is far beyond Insurances, ETF’s, Mutual funds, etc and not limited to these only. It’s a process which puts our lives in discipline. It’s like navigation. If we know where we are? Where we want to reach? Navigation is not such a problem it’s when we don’t know the 2 points that it’s difficult to navigate.

Its more than just good advice or Investment returns it’s about Guidance that you can trust. Our main goals as Financial Planner is to help you live the life of your dreams and make your money last till then and even after. After all, one must gain the control of our money or the lack of it will forever control us and the decisions that we make.

FOUNDATION

Figure out where you are, to see where you can go. We’ll work together to make sense of your financial statements and develop a risk management strategy. Then, we’ll develop a plan to get rid of consumer debt for life, so you can truly build wealth.

FORMATION

Plan, plan, plan. We maximize your investments to get you on track for retirement and college tuition for your kids. We’ll even look at your mortgage and see if it makes sense to pay it off sooner than later

FREEDOM

Peace of mind, for your whole family. We’ll collaborate directly with your attorney and other professionals, so you have an entire team focused on protecting your legacy. You get to focus on your loved ones, enjoying life, and giving back to the community.

If you don’t find a way to make money while you sleep, you will work until you die.

– Warren Buffett

Cash Flow:

“The secret of getting ahead is getting started”

It’s the first and the most important step in Financial Planning. Since if we know the most approximate source and end use of the hard earned money, only then we can prepare a plan to suit our requirements. Hence a detailed study of this aspect of personal finance is very important and most crucial one, which needs expertise. We at USP FinPro help our clients do this step thoroughly well.

Implementing a budget for yourself and your family is a difficult process for most people. Sticking to it is even tougher. However, the first step in effectively managing your finances is the creation of a budget. Developing and maintaining a budget is crucial to your ability to save, which allows you to achieve your short term & long term goals Managing and maximizing your personal cash flow is essential for obtaining your financial goals.

USP FinPro prioritizes cash flow analysis—it is the first item we review. Our financial advisors work directly with you and your family to analyze your living expenses in relation to your current financial situation. A reasonable, itemized budget is then determined and implemented. Your cash flow statement—factoring in your income, tax liabilities, and budgeted expenses—will paint a picture for you, dictating a short-term course of action. Adhering to the budget will usually result in a surplus of cash, which will ultimately lead to the achievement of your financial goals and objectives.

Investment Planning:

“If you are planning for a year, sow Rice, if you are planning for a decade plant trees, if you are planning for a lifetime, educate people”

As this Chinese proverb goes well, we have to follow the investing process with great determination and strong conviction.

At USP FinPro, we consider the investment strategies so personal and customized that the Client is comfortable and takes the ownership of implementing the recommendations and also religiously commits and follows the steps and reaches their goals in the stipulated time. The diversification aspect of investment is also taken into consideration.

All in all through thorough discussion and exhaustive seating we arrive at an investment plan which considers the Time horizon of the investment, Risk appetite of the Client, etc but not limited to. After all, Investment Planning is bringing your Future to Present so that you can do something right about it Now……………

Insurance Planning :

“You don’t buy life insurance because you are going to die, but because those you love are going to live.”

Insurance planning is a critical component of a comprehensive financial plan that includes evaluating risks and determining the proper insurance coverage to mitigate those risks. The principal goal of insurance planning is to identify and analyze risk factors in life and seek proper coverage to attain a peace of mind if disaster strikes. The chances of recovering partly or fully are assured by having insurance. Therefore, insurance is an economic device transferring risk from an individual to a company and reducing the uncertainty of risk via pooling.

It’s a part of good defensive game plan. It’s like carrying a spare tyre when you are driving, not that you will always need it but when you need one it better be there for You. Carrying insurance is crucial, but the most important aspect is carrying the appropriate type of insurance. Each person has different insurance needs tied to his/her unique situation, age, health, family structure, economic status, possessions, assets, and many other factors. There are several forms of insurance and there is no “one size fits all”. (This is why we need the insurance planning!) Also, any major change in life requires an immediate review of insurance planning to make sure the protection remains adequate.

Tax Planning:

“The hardest thing to understand in the World is Income Tax”

Tax planning is one of the most important aspect of financial planning. It forms an integral part of our saving plans. However nearly 90 % of financial mistake by individuals are made during the tax planning period.

At USP FinPro, we have an approach that, all the years through which we accumulate the Wealth we have been paying the taxes and then creating the wealth. Now when we are planning the investments if the proceeds are taxable again the whole idea of investing makes no sense to the clients. Hence we have special emphasis on Tax efficient investment solutions. At USP FinPro, we can arrange your investments in ways that would postpone or avoid taxes altogether. When you employ effective tax planning strategies, you have more money to save or invest, or both.

Financial planning and tax planning are closely connected due to the fact that taxes are a huge expense as you go through life. If you become very wealthy, taxes will be your single greatest expense over the long run, thus planning to reduce taxes is a critical part of the overall financial planning process.

Retirement Planning :

“Do something today that your future self will thank you for”

The question in retirement planning is not at what age one wants to retire, but at what income one wishes to retire.

For retirement planning, people tend to wait till the age of retirement or nearing to retirement which actually doesn’t serve the purpose. For retirement the actual asset is Time, hence the more time we can give to build the corpus that is, the earlier one starts with small amounts and then increasing the contribution year on year the chances are higher to achieve the desired Corpus. Also in financial planning terms, retirement is treated as a third child principle, by that it means, one needs to contribute equally to one’s retirement as one cares and contributes for one’s child. We at USP FinPro, we believe the retirement fund should be started the moment a person starts earning. After all we are responsible for our comfortable retirement not the government.

Estate Planning:

“The secret to success is to own nothing, but control everything”

Estate planning is an important and everlasting gift you can give your family and setting up a smooth inheritance isn’t as hard as you might think. Preparing a will is the simplest way to guarantee your funds and property will be distributed according to your wishes.

Estate planning is important since it will ensure:

- Providing support and financial stability for your spouse

- Preserving assets for future generations

- Supporting a favorite charity or other worthy cause

- Ensuring all of your assets, including those that pass by beneficiary designation (e.g., retirement accounts and life insurance policies), will be distributed according to your wishes.

- Minimizing taxes and expenses

- Ensuring that individuals you choose can make decisions on your behalf in the event of one’s incapacity Other than Will even different types of Power of Attorney are a way to continue your control over how money matter decisions are taken in your absence or in case of incapacity to take the decisions.

How would it feel to have complete Financial Freedom?

Financial Freedom encompasses all of the feelings that are completely opposite of the way many people feel about their money. Instead of feeling stressed, worried or lost, when you experience Financial Freedom, you enjoy a state of bliss, confidence and assurance.

Evaluate Your Needs :

To begin, we’ll work with you to identify your goals and individual financial circumstances.

Define Strategies :

We will create a personalized plan to help you take charge of your money and achieve your goals.

Choose the Right Products :

We will identify the right mix of investment products which you should opt depending on your current investments, risk profile, your age & goal period. Once you approve the product mix we go ahead with the implementation process

Evaluate Performances :

To make things easier for you, we’ll use an online Wealth Tracker tool that will show you all of your updated accounts and progress in one convenient, secure place. And we will together evaluate the performances of your investments from time to time.

Achieve you Goals :

Our relationship isn’t over after we create a plan; rather it’s just beginning. As you implement your plan, we will serve as your coaches to help you along the way until your Goal is achieved.

Why You Need USP FinPro?

Even the best athletes have coaches. As your Financial Planners, we coach you and provide tips along the way to help you stay on track.

You should consult with a Financial Planner if you:

- Want to manage your finances, but aren’t sure where to start

- Don’t have time to do your own financial planning

- Want a professional opinion about a plan you developed

- Don’t have sufficient expertise in certain areas such as investments, insurance, taxes, or retirement planning

- Have an immediate need or unexpected life event

- Need someone to hold you accountable

- Don’t have financial expertise or experience

We don’t believe in one-size-fits-all plans.

After listening to your goals, concerns, and values, we will analyze your situation and prepare a customized, objective, realistic recommendations to meet your specific goals.

We have the credentials and experience you can trust.

You can be rest assured knowing your financial advisory team holds highly regarded designations in the industry including all required certification. Each member of our team has rich experience to serve you the best.

We give goal specific advice with your best interests in mind.

USP FinPro is proud to offer free planning services to our esteemed clients – absolutely no company specific products are sold or pushed by our financial planning team. You can have peace of mind knowing that our Financial Planners give specific & goal base advice for your money management needs.

He who fails to plan, is planning to fail.

-Sir Winston Churchill